What is a London buy-to-let property and how you can benefit from this lucrative investment

London property market | 03.06.2024 | Benham and Reeves

Leading Indian newspaper, the Times of India recently revealed that ultra high net worth individuals from India, led by those living in the UK for generations, NRIs, investors, students and families travelling to the UK for education, are the biggest group of property owners in London.

Like most developed countries, the London real estate market has been through various periods of highs and lows, though on average, property prices in the UK capital are up 70% over the last decade. With the current crises of increasing cost of living, inflation and energy prices, is now the right time for an Indian investor to consider buying a buy-to-let property in this global mega city? The answer is a resounding yes – for many reasons!

In January 2023, the UK economy defied gloomy predictions and grew at a higher-than-expected rate of 0.3%. According to Land Registry data, the average London property grew in value annually by 6.7% — marking an increase of £33,988. Average UK property prices were £26,000 higher in December 2022 than at the start of the year, increasing 9.8% in the last 12 months.

What is a buy-to-let property?

A buy-to-let is an investment in a residential property that generates income via rent. Buy to-let or ‘BTL’ is a property that is purchased specifically to let with the intention of earning rental income and to earn a profit or capital gain upon selling the asset. The benefit of a buy-to-let property in London is that, in addition to providing a regular source of income, it also offers long-term financial security through capital appreciation.

Advantages of investing in a buy-to-let property in London

Essentially, your return on investment or ROI on a BTL property in London is built on 3 components:

- Rental Yield

- Capital Growth

- Currency Appreciation

For Indian investors, a buy-to-let property investment in London has the potential to generate high ROI, in addition to multiple other benefits:

- Stable monthly rental income – Rental demand is high due mainly to imbalance between supply and demand, with demand far outweighing supply of properties throughout the capital.

- Potential for capital growth – Historic data illustrates that in the long-term, London property tends to outperform not just other global cities, but also other asset classes, such as stock market investments and gold.

- Benefit of currency appreciation – The British Pound continues to hold its strength vs. the Indian Rupee.

- Diversification of Investment Portfolio – A solid asset class within a mature market, it allows Indian investors to diversify their income streams, away from the local market.

- Liquidity – London property is a highly liquid asset. It can disposed off easily to the strong demand throughout the year that is not met with sufficient supply

- Stability & safety – Stringent regulations by the UK Govt. with hefty penalties on non-compliance

What to keep in mind when choosing a buy-to-let property in London?

When looking for the best buy-to-let properties, here are a few parameters to consider to achieve an optimum return on you investment:

- Location – Gated community living with security, close to Tube stations and bus stops

- Amenities – Terrace or balcony, concierge, Gym, Swimming pool, Residents’ co-working spaces etc.

- Connectivity – Access to good transport links with easy access to central London and the City

- New vs. old – New apartments are easy to maintain and energy efficient

- Phase of the development – Generally, the start of a new development or its earlier phases are the most profitable; as development progresses, you can expect prices to move upwards.

- Other factors – Energy efficiency, Service charges to maintain the property are key criteria to look into

Why now is the right time to invest in London property

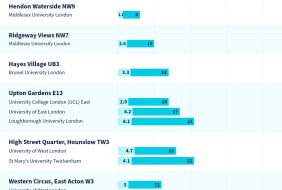

Being at the heart of the London property market with 20 prominently located London branches, we are experiencing a busy rental market properties let within days, sometimes, hours. Leading portal Rightmove has found that rents in London reached a record average high of £2,480 per month in the fourth quarter of 2022 while inner London rents surpassed £3000 per month for the first time.

Competition remains extremely high and asking rents continue to increase, due to imbalance between supply and demand, with demand far outstripping supply throughout the capital.

Over the years, London has proven to be a particularly lucrative and stable market for real estate investments. Even during economic downturns, the monthly rents for new private leases in the capital rose rapidly at 15%.

An additional benefit of expanding investments in the London market is the safe diversification of assets and an international property portfolio outside India. Due to consistently strong fundamentals, mature global property markets such as London provide Indian Investors with a hedge against adverse domestic events and market risk.

London rental market to see a new high in 2023

With demand for quality education in London on the rise, enhanced access to transport links, rising employment with growing business, an aspirational lifestyle and a positive economic sentiment, London will always be coveted. As professionals and students continuously move into the city to begin their careers and build their lives, there will always be a need for a good supply of property to rent in the capital.

The number of people searching for a rental property in London is 142% higher right now than five years ago. Through 2023, this trend is anticipated to continue, driving up rental costs even more. Recent figures also suggest that by 2025, more than 50% of adults under 40 will be renting.

How can you remit money from India to buy a property in London?

Liberalised Remittance Scheme (LRS) by the Reserve Bank of India permits every Indian resident, including minors, to freely remit up to USD 250,000 per financial year (April to March) for the purchase of a property overseas.

Each family member can remit $250,000 per person per financial year abroad — which can be done at any time during the year. Therefore, you can also club the LRS limits of four people and buy a property jointly in four names — bringing the total remittance value to $1m per financial year.

According to the Times of India, there has been a surge in investments by wealthy Indians in properties, equities, mutual funds and other instruments overseas permitted under the scheme. Indian investors sent $6 billion in overseas remittances during October-December 2022, contributing to a total of $20 billion in FY 22, up from the $13 billion remitted in FY 21.

With an increasing number of high net worth individuals from India seeking to diversify their portfolios, investment opportunities in overseas markets are becoming more popular than ever before.

How can Benham & Reeves help you?

With 65 years of experience operating in the London property sector, the Benham & Reeves team can provide end-to-end assistance to Indian investors to maximise the return on your London investment.

A growing challenge for many Indian Investors is finding a reliable partner to manage their property. With our ability to assist you with UK tax returns, furnishings, lettings and property management services — unlike other agents, our work begins as soon as your property purchase process completes and you have legal possession. Most agents don’t offer this level of service, but our clients realise how simplifying the management of their rental investments makes life easier, keeps tenants happy and boosts their profit margins.

If you are an active investor and would like to invest in some of London’s most profitable real estate opportunities, meet with one of our property consultants in Mumbai or Delhi today! You can also contact us for more information.

Related posts

Welcome to Sterling Place, the latest development by the UK’s leading property developer, Barratt London. Sterling Place will redefine modern living

Top 10 reasons why Hayes Village is the perfect opportunity for Indian homebuyers and investors

Are you an Indian homebuyer or investor seeking a golden opportunity in the bustling UK Capital? Look no further than Hayes Village in West London by

Invest in the world’s top student city with world class education – the best opportunities for Indian investors

London, a city steeped in history and culture, has long been celebrated as a global education hub. With its prestigious institutions attracting studen

Global property solutions

London property investment event's

What is Lorem Ipsum

-

01-Aug to 02-Aug 2024

The Leela Palace, New Delhi

8:00 AM to 9:30 AM

-

02-Aug to 03-Aug 2024

St. Ragis, Mumbai

2:00 PM to 3:00 PM

.jpg)